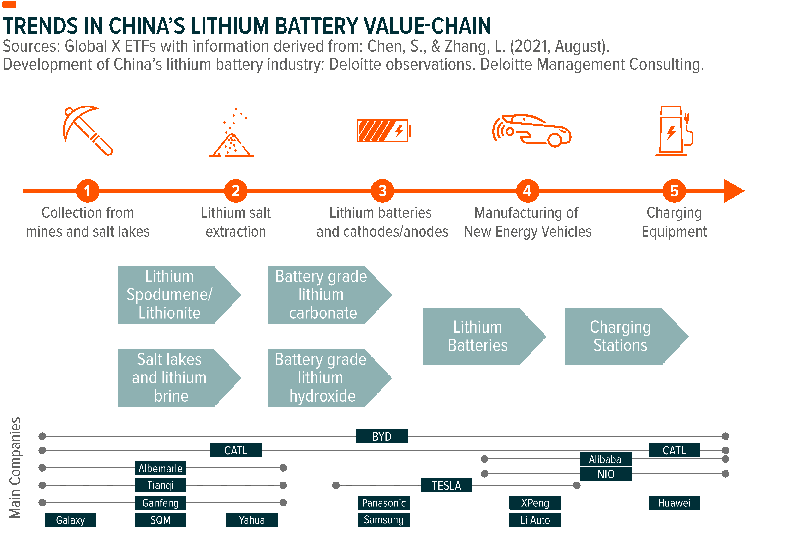

East Asia was always the center of gravity in the manufacturing of lithium-ion batteries, but within East Asia the center of gravity gradually slid towards China in the early 2000’s. Today, Chinese companies hold key positions in the global lithium supply chain, both upstream and downstream, representing roughly 80% of battery cell manufacturing as of 2021.1 The spread of consumer electronics such as cellphones and laptops boosted adoption of lithium-ion batteries in the 2000’s, and now in the 2020’s a global shift to electric vehicles (EVs) is putting wind into the sails of lithium-ion batteries. Understanding Chinese lithium companies is therefore crucial to understanding what’s powering the expected upcoming surge in EV adoption.

The Center of Gravity Shifted Towards China

Multiple Nobel Prize-winning breakthroughs led to the commercialization of lithium batteries, notably by Stanley Whittingham in the 1970’s and John Goodenough in 1980. While these attempts were not entirely successful, they laid the ground for Dr. Akira Yoshino’s crucial breakthrough in 1985, which made lithium-ion batteries safer and commercially viable. From there on, Japan had a leg-up in the early race to sell lithium batteries and the rise of South Korea made East Asia the center of the industry.

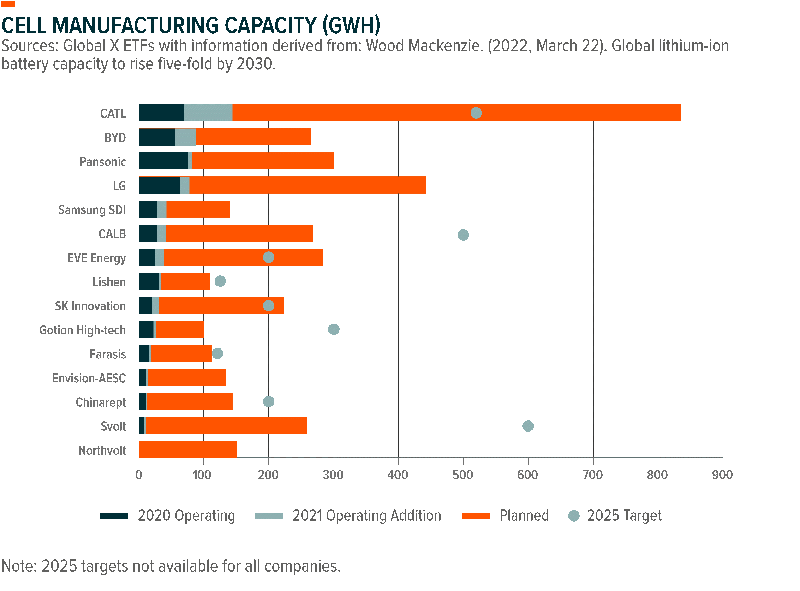

By 2015, China surpassed both South Korea and Japan to become the top exporter of lithium-ion batteries. Behind this ascent was a combination of policy efforts and bold entrepreneurship. Two relatively young companies, BYD and Contemporary Amperex Technology Company Limited (CATL), became trailblazers and now make up almost 70% of battery capacity in China.2

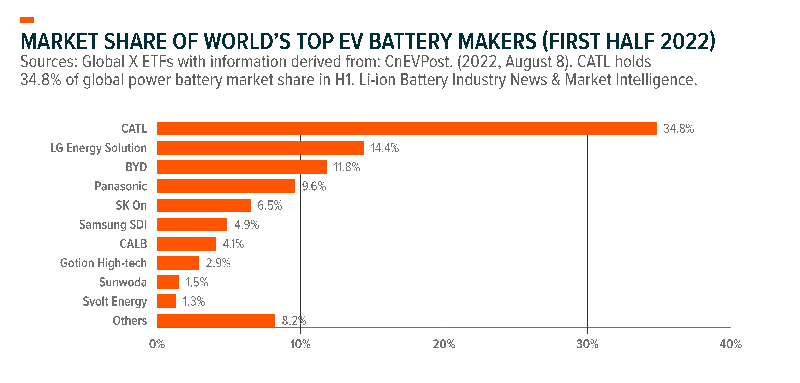

In 1999, an engineer named Robin Zeng helped found Amperex Technology Limited (ATL), which turbo boosted its growth in 2003 by securing a deal with Apple to make iPod batteries. In 2011, the EV battery operations of ATL were spun off into Contemporary Amperex Technology Company Limited (CATL). In the first half of 2022, CATL occupied 34.8% of the global EV battery market.3

In 1995, a chemist by the name of Wang Chuanfu headed south to Shenzhen, to establish BYD. BYD’s early success in the lithium industry came from manufacturing batteries for cellphones and consumer electronics and BYD’s purchase of fixed assets from Beijing Jeep Corporation marked the start of its journey in the automobile space. In 2007, BYD’s progress caught the eye of Berkshire Hathaway. By the end of the first half of 2022, BYD surpassed Tesla in global EV sales, though it comes with the caveat that BYD sells both pure and hybrid EVs, while Tesla focuses only on pure EVs.4

The rise of CATL and BYD was aided by policy support. In 2004, lithium batteries first entered the agenda of Chinese policymakers, with the “Policies to Develop the Automotive Industry,” and later in 2009 and 2010 with the introduction of subsidies for batteries and charging stations for EVs.5 Throughout the 2010’s, a system of subsidies provided $10,000 to $20,000 for electric vehicles and were made only available for companies assembling cars in China with lithium-ion batteries from approved Chinese suppliers.6 Simply put, although foreign battery makers were allowed to compete in the Chinese market, the subsidies made Chinese battery makers the more attractive choice.

EV Adoption in China Has Driven Lithium Demand

China’s leadership in EV adoption is part of the reason why global demand for lithium batteries is soaring. As of 2021, 13% of vehicles sold in China were either hybrid or pure EVs and that number is only expected to increase. The growth of CATL and BYD into global giants within two decades encapsulates the dynamism of EVs in China.

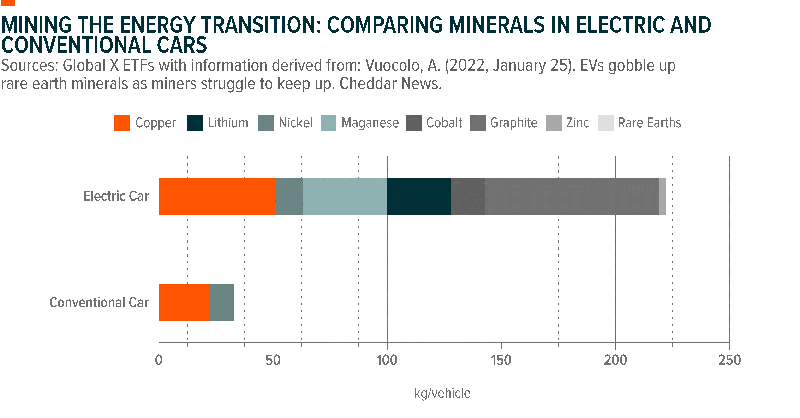

As EVs gain prevalence, demand is shifting away from nickel-based batteries back toward iron-based batteries (LFPs), which once fell out of favor for having a relatively low energy density (hence low range). Conveniently for China, 90% of LFP cell manufacturing around the world is based in China.7 The process of switching from nickel-based to LFP is not arduous, so China will naturally lose some of its share in this space, but China appears nonetheless well-positioned to maintain a dominant position in the LFP space for the foreseeable future.

In recent years, BYD has been pushing forward with its LFP Blade Battery, which drastically raises the bar for battery safety. With a new battery pack structure that optimizes space utilization, BYD revealed that the Blade Battery not only passed a nail penetration test, but the surface temperature remained cool enough as well.8 In addition to BYD using the Blade Battery for all of its pure electric vehicles, major automakers like Toyota and Tesla are also planning to or already are using the Blade Battery, though with Tesla some uncertainty remains over how much.9,10,11

Meanwhile, in June 2022 CATL launched its Qilin battery. Unlike the Battery Blade which aims to revolutionize safety standards, the Qilin battery differentiates itself more on energy density and charging times.12 CATL claims the battery can be charged to 80% within 10 minutes and can utilize 72% of battery energy for driving, both of which highlight tremendous growth in the technology behind these batteries.13,14

Chinese Companies Secure Strategic Position in Global Supply Chain

While the work of CATL and BYD in the EV space is important, China’s massive presence in upstream segments should not necessarily be overlooked. The lion’s share of raw lithium production happens in Australia and Chile, which have a global share of 55% and 26%. In the upstream, China only accounts for 14% of global lithium production.15 Despite this, Chinese companies established an upstream presence in recent years through a buying spree of stakes in mines around the world.

The buying spree is being conducted by battery makers and miners alike. A few notable examples in 2021 include Zijin Mining Group’s $765mn purchase of Tres Quebradas and CATL’s $298mn purchase of a Cauchari East and Pastos Grandes, both in Argentina.16 In July 2022, Ganfeng Lithium announced its plans to acquire 100% of Lithea Inc in Argentina at a price tag of up to $962mn.17 Simply put, lithium is a key ingredient behind the green revolution and Chinese companies are willing to invest in lithium to ensure they are not left out.

Energy Storage Shows Potential Amid Environmental Challenges

China’s commitments to attain peak emissions by 2030 and carbon neutrality by 2060 is part of what is driving the need for EV adoption. Another key ingredient to the success of China’s renewable goals is the adoption of energy storage technology. Energy storage goes hand-in-hand with renewable energy projects and that is exactly why the Chinese government is now mandating 5-20% of energy storage to go with renewable energy projects. Storage is crucial to keep curtailment, namely intentional reductions in electrical output because of a lack of demand or transmission problems, to a minimum.

Pumped hydro storage is currently the largest source of energy storage with 30.3 GW as of 2020, however roughly 89% of non-hydro storage is through lithium-ion batteries.18,19 Whereas pumped hydro is more suitable for long-term storage, lithium batteries are better suited for shorter duration storage, which is more of what is needed for renewables.

China currently has only about 3.3GW of battery energy storage capacity but it has plans for massive expansion. These plans are outlined in detail in the 14th Five-Year Plan for Energy Storage which was released in March 2022.20 One of the major objectives of the plan is to cut the per unit cost of energy storage by 30% by 2025, which will allow storage to become an economically desirable choice.21 Furthermore, under the plan, the State Grid hopes to add 100GW in battery storage capacity by 2030 to support renewables growth, which would make China’s battery storage fleet the largest in the world, albeit only marginally ahead of the US which is projected to have 99GW.22

Conclusion

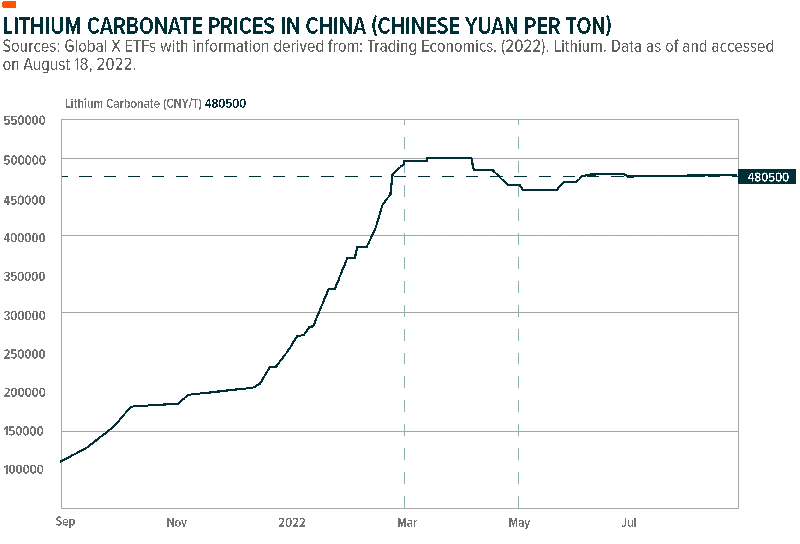

Chinese companies have already transformed the global lithium supply chain, but are continuing to innovate at a rapid pace. As a testament to their importance in the industry, as of Aug 18, 2022, Chinese companies made up 41.2% of the Solactive Lithium Index, which is an index designed to track the performance of the largest and most liquid companies active in the exploration and/or mining of lithium or the production of lithium batteries.23 Globally, lithium prices increased 13-fold between July 1, 2020 and July 1, 2022, up to $67,050 per ton.24 In China, the price of lithium carbonate per ton leaped from 105000 RMB to 475500 RMB between Aug 20, 2021 and Aug 19, 2022, marking an increase of 357%.25 With lithium carbonate prices up at or near historic highs, Chinese companies are naturally in a position to benefit.

This trend in lithium prices has helped both Chinese and US stocks related to batteries and lithium outperform volatile broad market indices amid adverse market conditions; between Aug 18, 2021 and Aug 18, 2022, the MSCI China All Shares IMI Select Batteries Index returned 1.60% against -22.28% for the MSCI China All Shares Index.26 In fact, Chinese battery and battery material stocks outperformed global lithium stocks, as the MSCI China All Shares IMI Select Batteries Index returned 1.60% against the Solactive Global Lithium Index posting return of -0.74% over the same period.27

We believe lithium prices will stay elevated over the coming years, acting as a potential headwind for battery makers. Looking forward, however, improvements in lithium battery tachnology can make EVs both more affordable and efficient, which in turn can boost demand for lithium. Given China’s influence in the lithium supply chain, we expect Chinese companies will likely play an integral role in the lithium industry for years to come.

Post time: Nov-05-2022